Bitcoin miners process transactions, solve complex mathematical problems, and secure the blockchain through the work they do. As a reward for this work, they get bitcoins. For every new block, miners received 12.5 bitcoins before 19:23 UTC, May 11, 2020. Following ‘the Halving’, this reward has dropped to 6.25 bitcoins.

The creator(s) of bitcoin encoded The Halving in the bitcoin algorithm as a feature.

What is the Halving and how does it Work?

The halving is the part of the bitcoin algorithm that distributes the coins. The pseudonymous creator of the digital currency/payment system, Satoshi Nakamoto, did not insist on explaining the halving. He/they just considered it ‘the best formula’ for coin distribution.

Every 210,000 blocks, the halving occurs, reducing the flow of newly created bitcoins, and with it, the inflation rate of the currency. It takes around four years to mine 210,000 blocks so, much like a leap year, the Halving is a recurring event. Furthermore, it coincides with leap years.

May 11’s halving was, therefore, the third bitcoin halving. The first one occurred in 2012, followed by the second in 2016.

The distribution of new bitcoins through mining rewards will continue till 2140. Following the mining of the last bitcoin, slated to cost several billions of dollars to accomplish, miner rewards will consist entirely of transaction fees.

We know relatively well when the last bitcoin will be mined because there will only ever be 21 million bitcoins in existence.

As past halvings have shown, the supply drop tends to exert an effect on the bitcoin price. Thus far, both halvings, the 2012 and the 2016 ones, had major delayed price-boosting effects. The crypto community, and slowly but surely, the entire world, has grown to associate the supply-dwindling events with price explosion.

Will the May 2020 halving trigger a similar price-wise reaction? To understand how this dynamic might work out we need to take a closer look at the previous two halvings.

The 2012 Halving

Having occurred on November 28, 2012, the first halving of the miner reward delivered the first demonstration of how dwindling supply would affect the price of the digital asset. This halving did not trigger a post-halving dump. With the price already in ascending mode, it gave it a massive boost, sending it onto a parabolic trajectory.

- 365 days before the 2012 halving event, on November 28, 2011, one bitcoin was worth $2.54.

- 365 days after the halving, on November 28, 2013, a bitcoin changed hands for $1,007.39.

- The price increase from the halving till the November 28, 2013 high was 8,069 percent.

This mostly parabolic run came to be known as bitcoin’s first “supercycle”. Following the mentioned high, the price dropped, but then rose again, at the beginning of the second supercycle.

The lessons the first halving event taught were clear and to the point. Radically decreasing the flow of a digital asset led to a price explosion no one could have predicted at that point.

According to experts, the entities powering this first price supercycle were almost exclusively cypherpunk specialists and early enthusiasts.

As bitcoin gained popularity, its second supercycle would lure in a different crowd: retail investors. Speculation would enter the picture as well.

The 2016 Halving

The second halving of the bitcoin subsidy occurred on July 9, 2016. With many more eyes upon it this time, the halving failed to immediately propel the price upward. It turned out to be the halving that introduced the post-halving dump. This dump was not a significant one in terms of price drop, and it was probably the result of overblown pre-halving hype. As it concluded, the bitcoin price resumed its mathematically-most-likely rise.

- 365 days before the halving, on July 9, 2015, the price had hit $269.68.

- At the halving, it was around $700.

- 365 days after the halving, on July 9, 2017, one bitcoin was worth $2,506.17.

- From that point onward, the price rose to the $20,000 all-time high.

Compared to the 2012 halving, the 2016 event resulted in slower and smaller gains. Still, these gains were massive compared to any other traditional financial asset. From a value measured in hundreds of dollars, bitcoin grew to have its worth measured in tens of thousands of dollars.

Following the second halving, a steady trickle of institutional investment began. The third halving would be powered by institutional money – proclaimed crypto talking heads.

Efforts to “tame” the wild price fluctuations of the asset commenced. The introduction of bitcoin-based financial derivatives saw out the second supercycle of the asset.

2020 Halving and Predictions

With more and more attention upon it, bitcoin’s third supercycle may be the most drawn-out and the most modest percentage gains-wise yet. Estimates range from highs around $50,000 to $200,000 in the wake of this last halving. Such predictions are all guesswork and you should always bear that in mind. There are absolutely no guarantees that bitcoin will go up, down or round-and-round in circles.

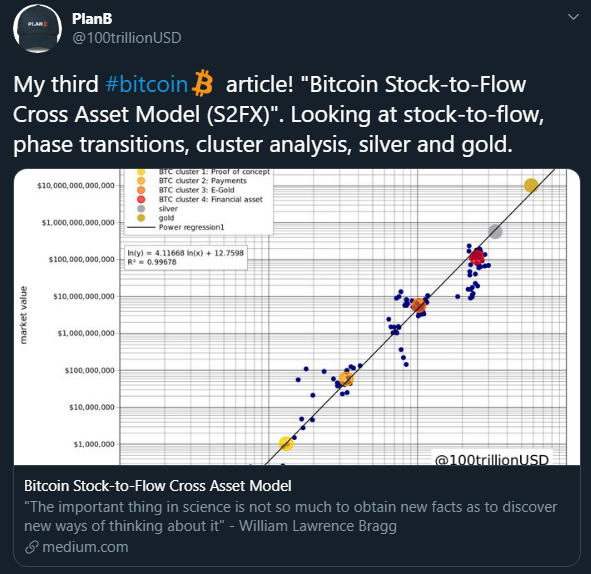

That said, an interesting prediction model to consider is one published by crypto enthusiast Plan B

The stock-to-flow model has become well known in crypto circles over the last handful of months. According to it, bitcoin has value because it has scarcity.

Cypherpunk founding father Nick Szabo defined scarcity as “unforgeable costliness” and as bitcoin halvings come and go, it becomes more and more obvious that this digital asset possesses that feature.

Plan B has quantified scarcity as S/F, where S is the stock (the existing quantity) of the asset, and F is the flow (the yearly production). As the flow drops, scarcity increases.

According to this model, the validity of which is supported by past data, the bitcoin price should hit $100,000 sometime in 2021-2022. Despite the already increased scarcity, price adjustment is delayed. We could see this same slow adjustment in action after the second halving.

This time, the adjustment may be even slower, due to factors such as the derivatives market.

Whatever the future brings price-wise for this unique crypto-asset, it is certainly fascinating to watch it follow its course in a manner unstoppable by anyone or anything. Satoshi and his peers, whoever they were, have set in a motion a sort of “digital force of nature” with bitcoin.