“I see Bitcoin as ultimately becoming a reserve currency for banks, playing much the same role as gold did in the early days of banking.” – Hal Finney.

Cryptocurrencies promise effective trust minimization, pseudo-anonymity, and “permissionlessness”. The fact that the true crypto blue-chip, Bitcoin, does not fall under the control of any authority, and that by now, it is arguably immortal, is just the cherry on the cake.

For those who understood the potential of Bitcoin, it has, however, promised much more since the very beginning. Coupled with smart contracts, Bitcoin could supplant entire industries, making legal representation and the entire existing financial industry redundant and obsolete.

DeFi is short for decentralized finance and it is the first step toward a decentralized financial industry that may one day fulfill all of our financial needs from getting a loan and issuing securities to exchange services, prediction markets, trading, etc. Below we answer beginners’ most frequent DeFi questions.

- What is DeFi?

- How does DeFi work?

- The peculiarities of dapps.

- How can you access and use DeFi apps?

- DeFi apps that already work.

- What you need to know about DeFi.

What is DeFi?

DeFi is a movement that leverages the powers and features of cryptocurrencies and smart contracts to provide a global alternative to every legacy financial service people use today. That means:

- Trading

- Insurance

- Banking

- Payments

- Exchanges

- Loans and savings

…and probably more.

How Does DeFi Work?

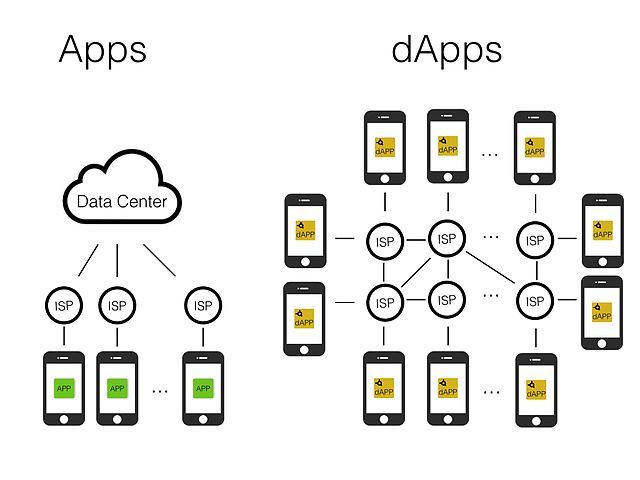

Certain blockchains, like Ethereum’s, support smart contracts. Smart contracts are programs (lines of code) that run on the blockchain and execute certain functions when a given set of conditions is met. By combining such smart contracts, blockchain engineers can create decentralized applications (dapps).

Such dapps form the backbone of DeFi. Programmers can set dapps to fulfill any role. There are already dapps powering lossless savings games and person-to-person loans, without the interference of any third party and without the need for the borrower and lender to know and trust each other. The possibilities in this regard are limitless.

Dapps are Different from the Software Banks Currently Use

No one entity controls decentralized apps and the way they run. Once their creators deploy them on the blockchain, they require no further management. In theory, DeFi apps do not require any further human intervention at all. In practice, developers do check and update their apps now and then.

Like the blockchains on which they reside, DeFi apps are global and permissionless. This means that they give everyone all over the globe the same opportunities. No one has to request permission from anyone to use DeFi services. There are no gatekeepers. The only tool users need to interact with a DeFi environment is their crypto wallet.

The DeFi user experience is already flexible and it will become more flexible in the future. Due to the open-source nature of dapps, anyone can review the code, debug it, and rewrite it. In the future, if a user does not like a given user interface, he/she will be able to recreate/reshuffle it.

DeFi code and transactions are transparent. On the one hand, this means that anyone can review dapps and see what makes them tick. On the other hand, users can track every transaction that happens on the blockchain. While transactions are public, they do not carry any information about users’ real-life identities. Thus, the entire ecosystem, much like Bitcoin itself, is pseudo-anonymous.

Perhaps the most intriguing aspect of the dapps ecosystem is that its bits and parts are compatible and interoperable. What that means is that programmers can use various already existing programs to build new applications through their combination. A good example in this sense would be a DEX (decentralized exchange) using its dedicated stablecoin and running a trading/market prediction service.

How Can you Access and Use DeFi Apps?

To access a DeFi app and thus to become part of the DeFi movement, all you need is a cryptocurrency wallet. If you already possess some cryptocurrency, you most likely have a wallet as well. Hardware wallets are recommended, although in this case, you will need a wallet that supports a dapps browser, like the Coinbase Wallet.

Some workarounds allow you to use dapps through other wallets as well, though these entail the installation of additional software.

In the future, DeFi will likely turn your wallet into a gateway to all the financial services you need. It will work like the browser does these days, letting you access and visualize a wide range of information and apps.

Wallets developed specifically with DeFi in mind and advertised as such, exist as well. Here is what you should look for in a DeFi wallet.

Accessibility and asset support determine whether you can use a wallet to deposit ETH in tandem with ERC20, ERC721 tokens, and various stablecoins.

All DeFi wallets come with a unique key pair. If you have a hardware wallet you are likely familiar with such seed-phrases. The wallet should not be a centralized one. With DeFi wallets, users take full responsibility for the safekeeping of their private keys.

DeFi wallets are non-custodial. “Not your keys, not your Bitcoin.” – goes the saying. Your keys, your crypto – we might add.

Many wallets have recently added dapps browsing functionality. This way, they significantly simplify their connecting to a DeFi application.

DeFi Apps that Already Work

If you have a cryptocurrency wallet, you can already access a surprising range of DeFi services.

- MakerDAO has made waves in the crypto world thanks to its DAI stablecoin. This coin is a crypto-backed one, unlike some other DeFi stablecoins, that are backed by USD in audited bank accounts. Above and beyond its stablecoin, however, MakerDAO aims to become a decentralized reserve bank. It has set up a governance model toward this end, based on its MKR token.

- Compound is a decentralized lending and borrowing platform. It allows users to lend out their crypto, thus earning interest on it. Users who deposit their crypto can borrow against it. There are several other such services and even dapps that allow the easy comparing of interest rates.

- Uniswap is a DEX (decentralized exchange). With it, crypto holders can trade their coins directly from their wallets. A decentralized exchange performs automated market making, and it allows participants to become liquidity providers, rewarding them with a cut of the exchange fees.

- Synthetix is a dapp that allows users to create synthetic assets based on their real-life counterparts, such as gold, oil, and various currencies.

- PoolTogether lets users combine their DAI holdings. The interest the combined pot earns goes to a winner. The rest of the funds go back to the depositors.

What Else Do You Need to Know About DeFi?

You may have heard the expression “ETH locked in DeFI”. This is a metric that depicts the success of the DeFI sector as a whole.

Because dapps work on the Ethereum blockchain, they require ETH to run. It makes sense to lock ETH into dapps through smart contracts. Dapps may use the internal currency to exchange value, to power the consensus mechanism, to support development, and to create an economic environment in which the dapp may thrive.

The more DeFI apps there are, the more ETH they use up. Thus, the “ETH locked in DeFi” metric offers a good depiction of the proliferation of decentralized finance in general.